| Chart of the Day |

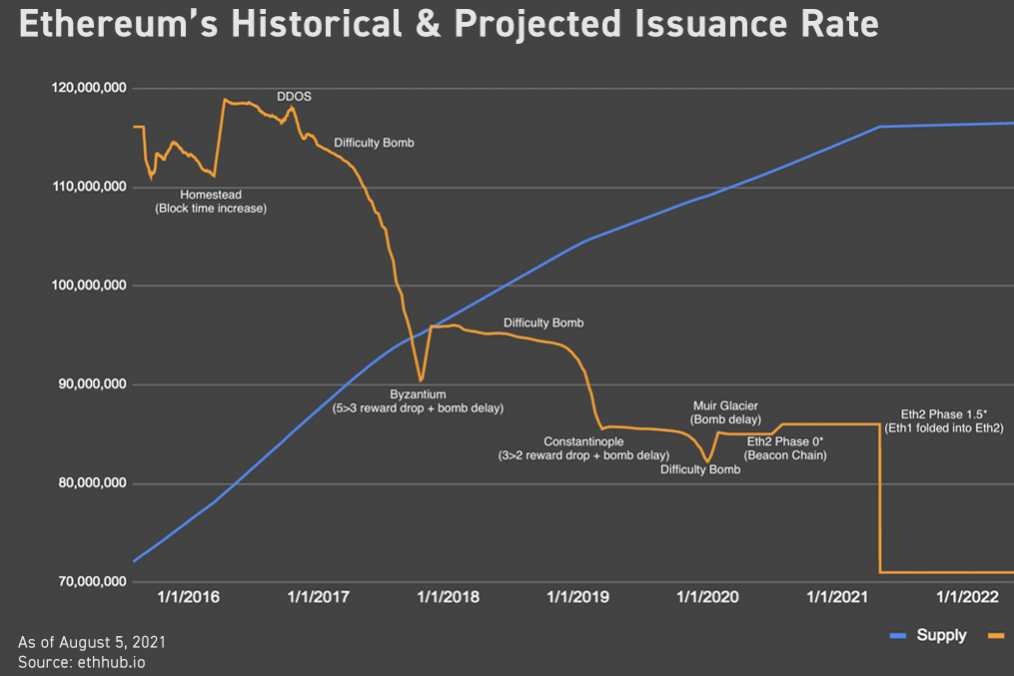

| The London Upgrade, the largest update to the network’s core protocol in years, has been activated. The most notable change — EIP 1559 — constitutes a major shift in the economics of Ether through the initiation of a more predictable fee structure that also reduces ETH supply. So far, Ether has been an inflationary asset with new issuance increasing total supply over time. Burning the base fee, i.e. removing them permanently from circulation, will reduce total supply and catalyze the transformation of Ether to a “store of value” not unlike Bitcoin. The shift toward a deflationary asset will likely attract more institutional interests and bring about broader adoption. However, the London Upgrade, among many steps toward deflation, did not alter the underlying Proof-of-Work mechanism. The paradigm shift that moves Ethereum away from mining entirely is Eth2, indicated by a vertical dive on the chart. |

| Talk of the Town |

|

| Post-Petro Magical Realism. The Central Bank of Venezuela announced that the digital bolivar, the country’s native CBDC, will be put into circulation on Oct. 1. The release of CBDC will be in tandem with a monetary redenomination that eliminates — dramatic drum roll lead-up — six zeros from the currency, to curb the country’s rampant inflation and advance monetary sovereignty. The CBDC’s predecessor, a cryptocurrency named Petro backed by Venezuela’s oil and mineral reserve, has successfully shaved off five zeros. In case you are wondering about the exchange rate, the Bloomberg Cafe Con Leche Index sets the cost of a cup of coffee at around 7 million bolivars, just a little under $2. |